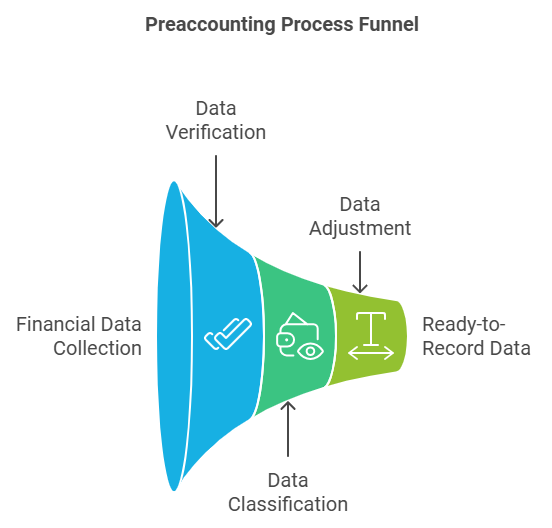

Preaccounting is the process of preparing and organizing financial information before it is recorded in a business’s accounting records. This process typically involves gathering and verifying the accuracy of financial data, classifying the data into the appropriate accounts, and making any necessary adjustments to ensure that the data is complete and ready to be recorded in the accounting records.

Preaccounting is an important step in the accounting process because it helps to ensure the accuracy and completeness of a business’s financial information. By verifying and classifying the data before it is recorded, preaccounting helps to prevent errors and omissions in the accounting records, which can lead to inaccurate financial statements and incorrect business decisions.

What is Involved in Pre-Accounting

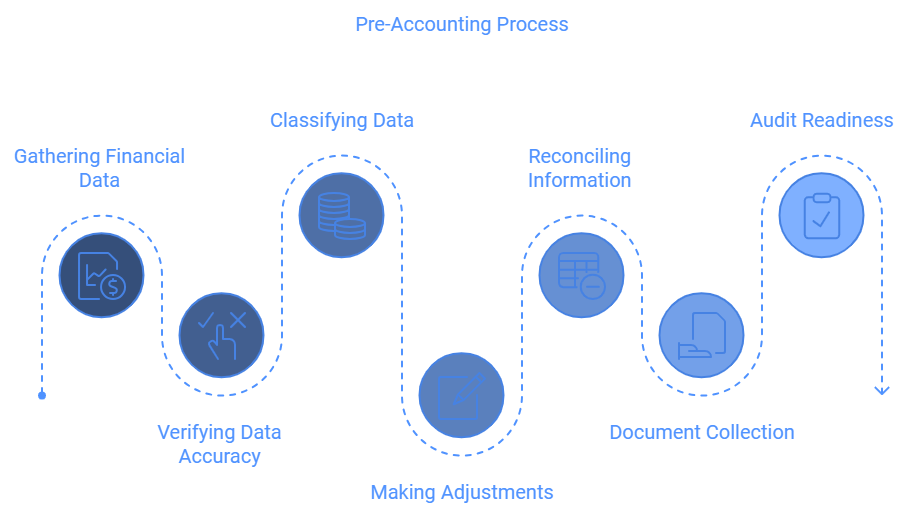

Preaccounting typically involves several key steps, including:

Gathering financial data

The first step in preaccounting is to gather all the financial data that will be needed for the accounting records. This may include source documents such as invoices, receipts, and bank statements. It may also includeany other financial information that is relevant to the business’s transactions.

Verifying the accuracy of the data

Once the financial data has been gathered, it is important to verify its accuracy. This may involve checking the data against the source documents, reconciling it with bank statements, and ensuring that it is complete and accurate.

Classifying the data into the appropriate accounts

Once the data has been verified, it needs to be classified into the appropriate accounts in the business’s chart of accounts. This involves determining which accounts should be used to record each transaction. The determination is based on the type of transaction and its impact on the business’s financial position.

Making any necessary adjustments

In some cases, it may be necessary to make adjustments to the financial data before it is recorded in the accounting records. For example, if there are any errors or omissions in the data, these will need to be corrected before the data can be used to prepare the financial statements.

How Pre-Accounting Works

Reconciling Information

Reconciling information involves collecting all data associated with every transaction and inputting it into an automated accounting software or ERP system. This allows for detailed tracking of both revenue streams and business spend so that any disparities can be easily identified and addressed promptly.

Unlock the Blueprint to Financial Success in Singapore!

Empower your business with strategies, insights, and tools tailored for the modern Singapore entrepreneur.

In addition, pre-accounting sets the stage for better forecasting capabilities so that businesses can plan ahead more accurately according to their current circumstances.

Document Collection

At a time when efficiency is key, pre-accounting can help businesses save time and maximize productivity. Automated processes can be implemented to streamline document collection, as well as file management and data organization for future reference.

For instance, cloud storage enables cost savings by reducing the need for physical filing cabinets and onsite hard drives. Not only does this free up office space but also allows documents to be securely stored in one central location with easy access whenever needed.

This type of time saving strategy helps organizations quickly capture receipts and submit purchase details to finance teams without creating any extra workload. Moreover, it makes sure that all records are accurately tracked while maintaining audit readiness at all times.

Audit Readiness

Audit readiness is an integral part of pre-accounting processes. By properly managing financial information, businesses can better prepare their audit scope and ensure they are ready for any potential audits that may arise.

Companies can improve upon existing internal controls to reduce risk while also creating more accurate financial projections and tax planning strategies. Pre-accounting helps provide peace of mind that all records are accurately tracked in preparation for a thorough assessment by auditors.

Achieving this level of accuracy requires the consolidation and organization of data into one centralized storage system which allows finance teams to monitor their accounts with confidence at all times.

The Benefits Of Pre-Accounting

Pre-accounting can help save both time and money, as it allows businesses to prepare financial records in advance and ensure accuracy. It can also help to provide more accurate financial reporting, and minimize financial risks. Overall, pre-accounting can be a great help to businesses, helping them save resources and reduce their financial exposure. We, at Bluebox, strongly recommend taking advantage of pre-accounting services.

Time And Money Saving

Pre-accounting is a valuable tool for saving time and money. By monitoring expenses, tracking payments, automating tasks and simplifying processes, businesses can quickly gain insight into their financials without having to manually enter data. This makes it easier to analyze data in real-time and make informed decisions that will optimize budgeting and reduce risks of high-cost transactions.

Pre-accounting eliminates the need to spend hours collecting receipts and entering them manually into an accounting system – freeing up more resources to focus on strategic initiatives that move your business forward. Ultimately, pre-accounting gives you visibility into your finances so you can maximize efficiency while minimizing cost.

More Accurate Reporting

Pre-accounting is a valuable tool for helping businesses manage their finances and gain more accurate reporting. Automating processes such as receipt collection, invoice extraction and data entry allows finance teams to save time while ensuring fiscal control.

See How We Drive Revenue Growth for Our Clients

Explore the insights and tactics that fuel our clients success

Data standardization also helps streamline operations by providing real-time analytics that can be used to make informed decisions regarding budgeting and risk assessment. With pre-accounting, organizations have access to up-to-date financials at all times, allowing them to quickly identify essential information and take advantage of cost savings opportunities.

Ultimately, these tools provide greater visibility into business expenses so companies can maximize efficiency without sacrificing accuracy.

Conclusion

Overall, preaccounting is the process of preparing and organizing financial data before it is recorded in a business’s accounting records. By verifying the accuracy of the data, classifying it into the appropriate accounts, and making any necessary adjustments, preaccounting helps to ensure the accuracy and completeness of a business’s financial information. This is an essential step in the accounting process, as it helps to prevent errors and omissions in the accounting records and ensures that the business’s financial statements are accurate and useful for decision-making.

Pre-accounting is an important tool for any business looking to stay on top of its finances. With the right qualifications and training, pre-accounting can help reduce risks associated with traditional accounting systems while providing a cost-effective solution. At Bluebox, we understand that pre-accounting may be unfamiliar territory for many businesses. That’s why we strive to provide comprehensive guidance and support every step of the way as you make this transition. We’re here to ensure your success in implementing pre-accounting – now and into the future.

Frequently Asked Questions

What Qualifications Are Required For Pre-Accounting?

Pre-accounting is a career path that requires proficiency in multiple areas, including auditing standards, financial reporting and data analysis. A successful pre-accountant should be knowledgeable about the most up to date accounting software and have experience working with big data.

Having an understanding of the many rules and regulations related to financial documentation is also essential. To qualify for a pre-accounting position, applicants must typically possess at least a bachelor’s degree in finance or accounting as well as some professional experience.

What Kind Of Training Is Needed To Become Proficient In Pre-Accounting?

Pre-accounting requires a comprehensive understanding of investment strategies, accounting software and data analysis to be successful. Training in financial forecasting, credit management, and other related topics is essential for anyone looking to become proficient in pre-accounting.

Professional organizations such as the American Institute of Certified Public Accountants offer courses that can help individuals gain expertise in this field. Additionally, there are many online resources available to those interested in learning more about pre-accounting.

What Are The Risks Associated With Pre-Accounting?

When it comes to pre-accounting, there are certain risks that must be taken into consideration. Outsourcing risks can arise if the data accuracy is not verified or software tools are inadequate for audit preparation. Additionally, financial analysis of the data should be performed regularly in order to ensure accuracy and completeness.

It’s important to have a strategy in place so these risks can be managed effectively, allowing firms to focus on providing quality services instead of worrying about potential errors or inaccuracies.

How Does Pre-Accounting Compare To Other Accounting Systems?

Pre-accounting is a form of accounting that differs from other systems in its approach to financial reporting, data analysis and budgeting principles. The auditing standards for pre-accounting are more flexible than traditional accounting methods, allowing greater freedom when it comes to the taxation implications of transactions.

It also offers users the ability to develop tailored solutions for their business needs with access to real-time analytics and insights. As such, pre-accounting provides an efficient alternative to standard accounting practices.

What Is The Cost Of Implementing Pre-Accounting?

When considering the cost of implementing pre-accounting, it is important to consider a cost benefit analysis and budgeting strategies. Conducting financial forecasting and accounts receivable can help identify where investments should be allocated for optimal results. When these strategies are paired with regular monitoring and evaluation, they enable businesses to make informed financial decisions and adapt to changing circumstances. By comparing budgets to actual results, organizations can pinpoint discrepancies, assess financial performance, and refine their spending plans for greater efficiency. This iterative approach ensures that resources are allocated effectively to achieve both short-term targets and long-term financial goals.

Additionally, data security must also be taken into account when evaluating costs in order to ensure that the investment does not result in any potential losses due to cyber threats or other malicious activity.